## Introduction: Embracing a New Chapter

Retirement may seem like a distant reality to many millennials and Gen-Z professionals, but understanding its essence can reshape your mindset today. Inspired by stories from those who’ve crossed that threshold, it’s evident that retirement isn’t just an end; it’s a transformative phase filled with opportunities to reconnect with yourself, redefine your purpose, and navigate relationships in new ways.

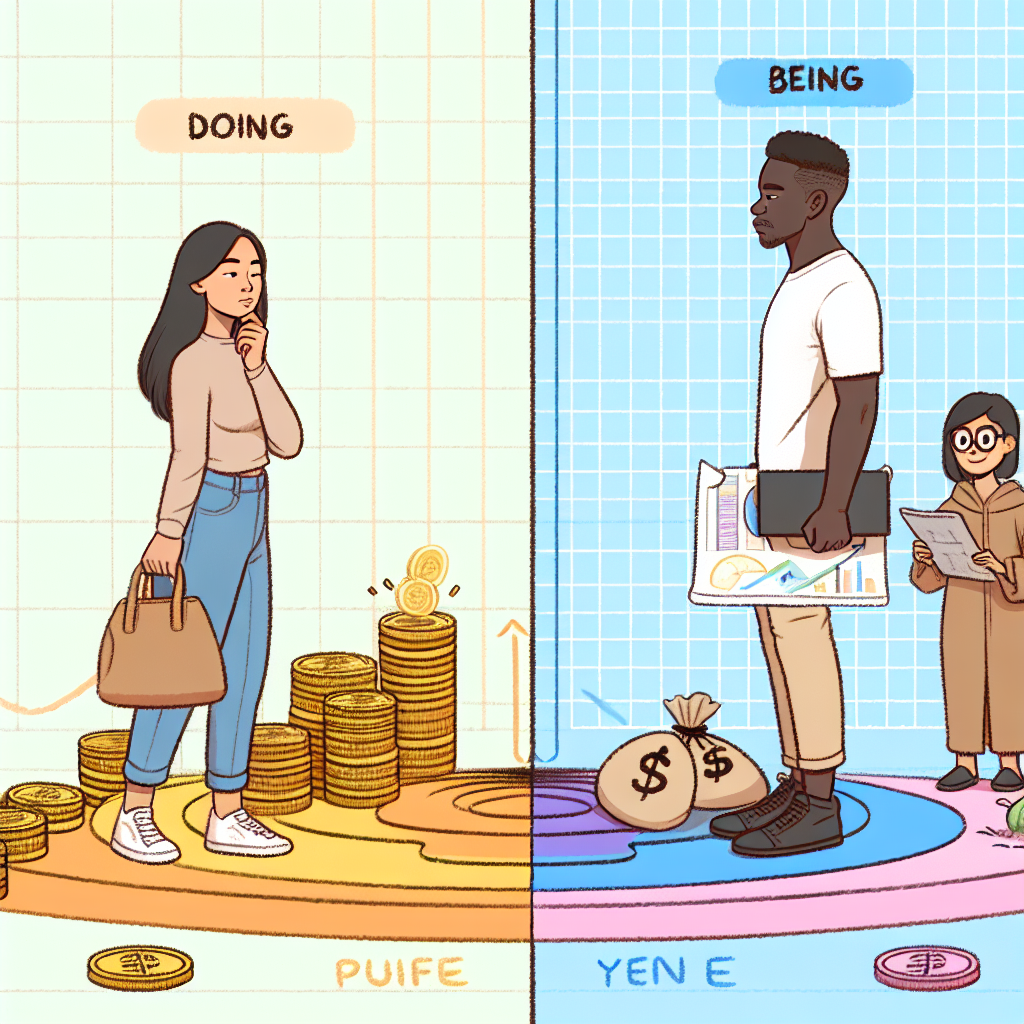

Let’s explore how the experience of embracing ‘being’ rather than ‘doing’ can lead to a more enriching life, regardless of your current career stage.

## The Balance of Being vs. Doing

As a young professional, it’s easy to get caught up in a cycle of constant achievement—ticking off tasks, meeting deadlines, and climbing the career ladder. However, much like the characters in the writings of Ursula K. Le Guin, it’s essential to pause and reflect on what it means to ‘be.’

Retirement offers a peculiar space for reflection after a life filled with activity and responsibility. It’s a chance to breathe, observe, and reevaluate your identity outside of work-driven roles. So, take this moment to consider: What activities impact your well-being that might seem unproductive on the surface?

These moments of ‘being’ are just as valuable as they guide you towards self-discovery and personal fulfillment. Notably, engaging in hobbies you might have neglected due to career pressures can ignite creativity and contribute to mental wellness—an important aspect for financial stability.

## Transitioning from Work to Leisure: It’s Not Just About Rest

Many envision lazy days by the pool or endless TV marathons when picturing retirement. However, transitioning from work to leisure is often more complex. After years of structured schedules, giving yourself permission to simply ‘be’ can ignite feelings of guilt or anxiety: “Am I doing enough?”

To combat this, begin with simple adjustments. Dedicate a portion of your day to activities that do not yield immediate financial returns—be it painting, gardening, or meditating. Allow yourself to indulge in these ‘unproductive’ pursuits, as they can lead to genuine joy and insight into who you are apart from your work identity.

Financial Planning Tip: Allocate a budget for leisure activities that enrich your life. This can be seen as an investment not just in happiness, but also in maintaining the balance necessary for long-term career success and satisfaction.

## Relocation: A Shift in Environment

For some, retirement comes with a physical move to a new place. This shift can spark excitement and trepidation. If you’re contemplating a change in scenery, consider renting before fully committing. For instance, if you’re contemplating a move from the East Coast to the West Coast, spending a year in a new location allows you to immerse yourself without feeling overly tied down.

Building a supportive network, such as moving to an area where you have friends or family, can also facilitate this transition. Many people find that new connections and participation in local activities related to their interests can provide emotional and financial support. Just as all major life changes, reflection and careful planning lead to less regret and more satisfaction.

## Understanding Your Spending Habits in Retirement

As you transition into this new phase of life, a looming question arises: How will your financial habits shift? Conventional wisdom often suggests you’ll need a certain percentage of your pre-retirement income, but the reality can differ significantly.

Many retirees find that their spending habits evolve—often leading to greater expenditures in areas such as dining and hobbies. Understanding these shifts is crucial. Being mindful of your spending habits as you step into retirement can help ensure you’re making decisions aligned with your long-term financial goals.

Actionable Strategy: Build a flexible budget that accommodates both new pursuits and savings. Dividing your budget into categories will help you navigate uncharted financial waters with confidence.

## Navigating Relationship Changes in Retirement

Retirement can significantly impact relationships, especially for couples. Diverse aspirations and differing interests often emerge, leading to discussions about how to spend this newfound time together—or apart. Understanding each partner’s needs and how they may change is essential.

Maybe one partner appreciates quiet evenings while the other thrives on adventure. It’s crucial to strike a healthy balance where both individuals can pursue personal interests while cherishing time together. Consider creating a shared calendar that includes individual activities alongside couple time to ensure mutual fulfillment in this new journey.

## Takeaway: Welcome the Gift of Living Fully

Regardless of where you are on your professional journey, nurturing a mindset that values ‘being’ over ‘doing’ can lead to a more fulfilling life. Embrace the concept of retirement now by prioritizing self-reflection, creating space for leisure, and paving the way for future transitions through careful budgeting and planning.

Whether through relocation, adjusting spending habits, or navigating complex relationship dynamics, remember that retirement could be just around the corner, and preparing for it starts today.

As you embark on your financial journey, consider: What steps can you take now to align your financial habits with your personal fulfillment, paving the way to a retirement that’s meaningful and enriched by the life you’ve lived—and the one yet to come?

Leave a Reply